Financial Competency

Christee will allow you to deliver clarity, and provide clients with the best options and guidance.

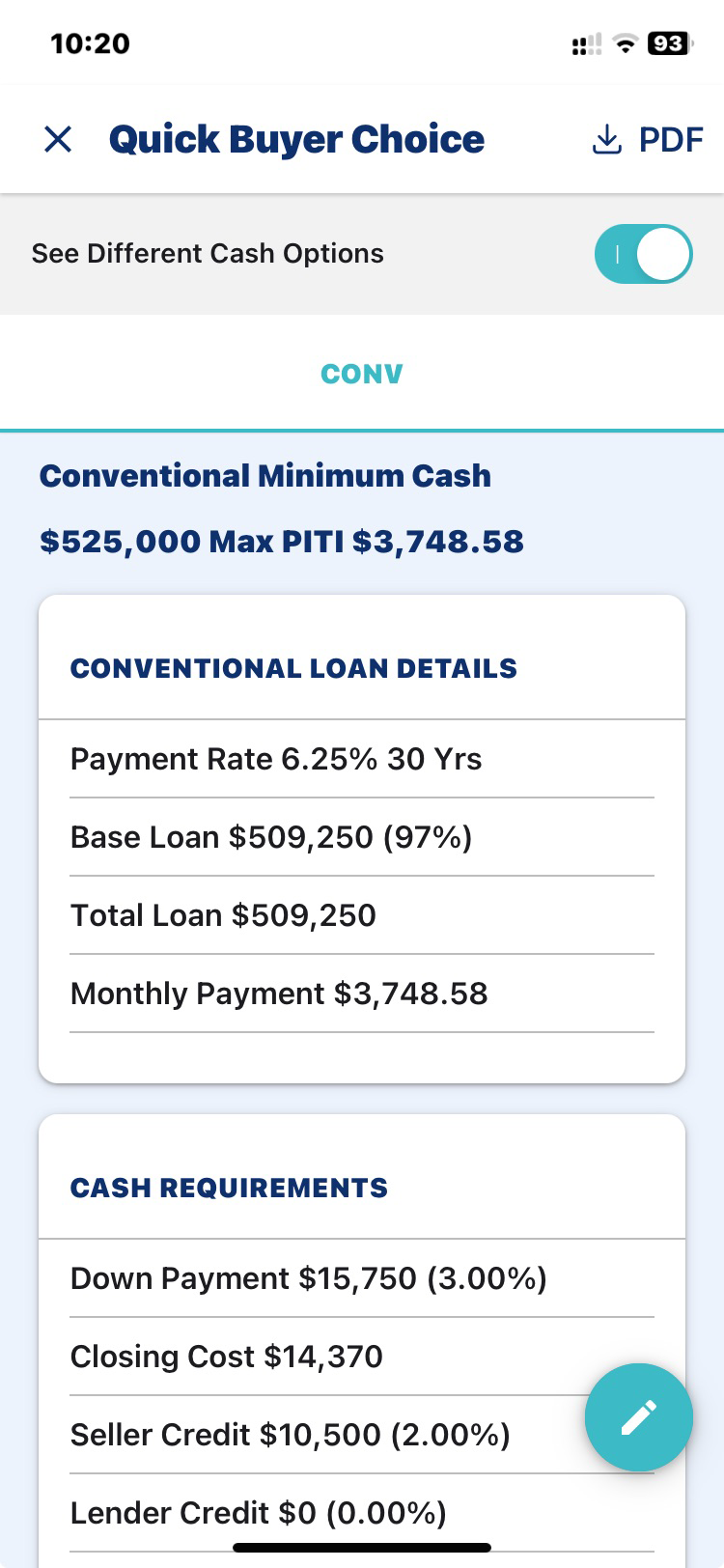

Client Confidence

Christeee technology reduces stress, boosts transparency, and strengthens trust and communications with clients and lenders.